Chicago- March 17, 2025

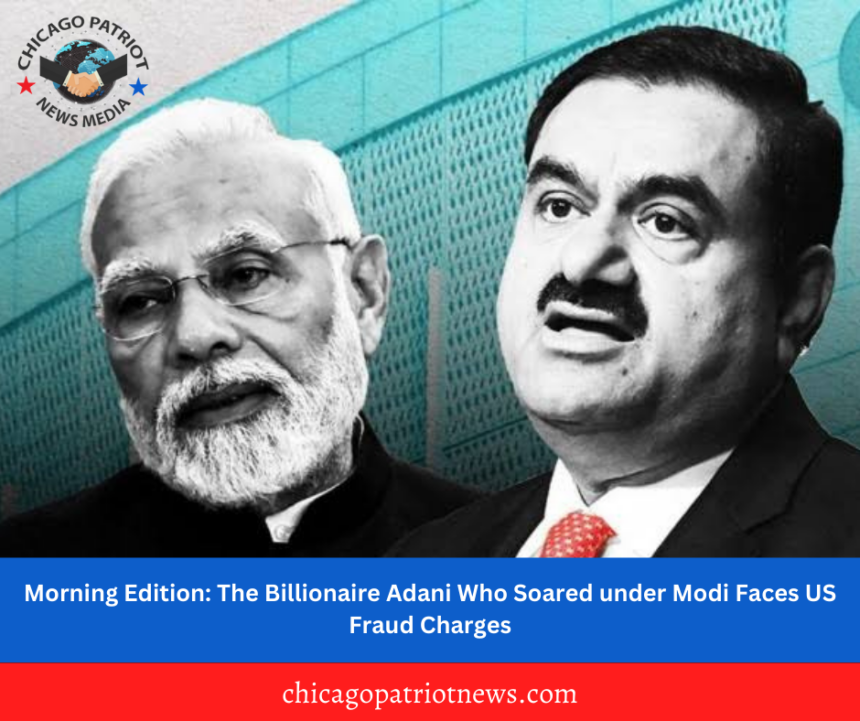

Gautam Adani, among the richest men in the world, is by far Narendra Modi’s favourite tycoon. So much so that when Modi was to be first sworn in as India’s prime minister after sweeping the 2014 general election, the private aircraft he travelled by to New Delhi prominently displayed the logo of the businessman’s multinational conglomerate, the Adani Group.

The sixty-two-year-old Adani has been close to Modi for more than two decades. The stars of the two men have risen in tandem since 2002, soon after Modi first became the chief minister of the state of Gujarat, where Adani’s firms benefited tremendously from favourable government decisions.

From these humble origins, the group has now expanded into infrastructure, power generation, mining, gas distribution, renewable energy, airports, cement, and media—its share prices rising to stratospheric levels after Modi’s ascent to the prime minister’s post. In Modi’s first year in office, the market value of the group rose by approximately $5.7 billion(US, in today’s terms).

Adani has acquired the operations of eight airports in the country over the past decade, in addition to operating thirteen ports. Taken together, the group accounts for about a quarter each of India’s air passenger footfalls and seaport capacity. Recently, the Guardian reported that the Indian government relaxed national security protocols to enable the construction of a renewable energy park within a kilometre of India’s border with Pakistan—a project Modi launched in 2020 and now with the Adani Group.

This close relationship between Adani and Modi came into sharp focus internationally when, this past November, American federal prosecutors accused the businessman of a conspiracy to commit bribery and defraud investors on the basis of false statements. Prosecutors alleged that Adani and his associates promised to pay more than $250 million (US) to Indian government officials to secure lucrative solar power contracts for Adani Green Energy Limited and Azure Power Global Limited—deals projected to generate $2 billion (US) in profits over two decades—before misleading Wall Street.